Data Replication

Real-world Use Case: Avoid Data Corruption by Switching from Passive Replication to Automated Failover and Recovery

Paden R. Holenstein

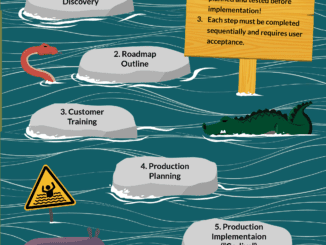

Stepping Stones for a Successful Migration

Paden R. Holenstein

Demystifying PCI DSS 4.0: The Ultimate Guide to Protecting Your Business from Cyber Attacks!

Steve TcherchianPCI DSS (Payment Card Industry Data Security Standard) compliance is a set of security standards with which organizations who handle payment card data must comply. The purpose of these standards is to ensure that sensitive information like credit card numbers and personal data are protected from unauthorized access and theft.

ICYMI (In Case You Missed It) – HPE Shadowbase – What’s New in ’22?

Paden R. Holenstein

HPE NonStop, what does Artificial Intelligence think about it?

Casey KrasnerWith the emergence of ChatGPT and other AI tools in 2022, we are seeing the impact these tools can have on individual job roles and entire industries. While AI has not entered into the NonStop space just yet, it is still something we as technologists and self-proclaimed nerds are watching from a distance.

NTI: A NonStop Vendor’s Resurgence to Prominence

Richard Buckle

Use HPE Shadowbase Essentials Software for Data Management, Monitoring, and Control

Gravic, Inc.

Data Replication Solution Migration – Discovery

Paden R. Holenstein

Use HPE Shadowbase Compare and Repair Software for Data Validation and Verification

Gravic, Inc.

Leverage Heterogeneous Data Transformation and Distribution to Create New Business Opportunities

Paul HolensteinReal-time data replication products, such as HPE Shadowbase software, are well known for their ability to facilitate IT service availability (Business Continuity) by replicating production data in real-time across multiple systems to create backup database copies. Should one system fail, current, consistent data is available on alternate systems which can take over processing, thereby maintaining service availability. But such products also provide another significant capability: a heterogeneous Data Distribution Fabric Backbone (DDFB), which facilitates data integration.

Kafka and HPE NonStop – A Perfect Combo

Phil Ly

HPE Shadowbase Zero Downtime Migration Software Eliminates Planned Downtime and Business Risk!

Gravic, Inc.

Parts Distributor Utilizes Zero Downtime for Application, Modernization, and Digital Transformation

Paden R. HolensteinIn my previous article, Thinking of Migrating During a Pandemic?, I wrote about how impressed I was with the different IT initiatives and buzz of activity that increased from the pandemic. Situations like this pandemic truly highlight how much we all take technology for granted, and how interwoven our lives have become.

NonStop Collaboration / Networking Is Key to TANDsoft’s Success

Janice Reeder-Highleyman

Easily Modernize and Expose Valuable Enscribe Data – Eliminate Data Silos

Gravic, Inc.A large European steel tube manufacturer ran its online shop floor operations on an HPE NonStop Server. To exploit the currency and value of this online, trapped, and siloed data, the manufacturer periodically generated reports on Linux Servers using a customized application and connectivity tool that remotely queries the online NonStop Enscribe database and returns the results.

Data Replication and Integration – Applications in Financial Services

Gravic, Inc.A major U.S. merchant provider operates a major payments transaction authorization switch – to several million small to medium-size businesses throughout the world. The merchant processes payment authorization for Visa, MasterCard, American Express, Discover, Diners Club, and other major credit and debit card client companies. The cards are issued by banks and other financial institutions for consumer purchasing at brick-and-mortar and online stores, and for withdrawing cash from ATMs. Each card transaction must be approved by the issuing bank before it can be accepted by a merchant or an ATM.