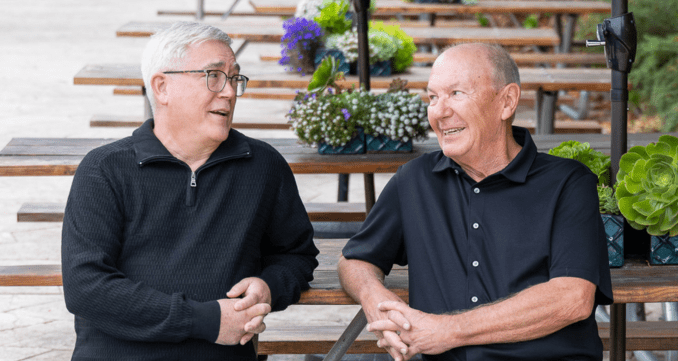

Technology veterans Jim Bowers and Jim Knudsen, sales engineers at IR, talk candidly about the evolution of NonStop systems, and why banks can’t afford to ignore monitoring and making sense of their data.

In the not-so-distant future when nothing short of real-time systems will do, HPE NonStop’s availability, scalability and security—combined with the expertise to fuel business optimization—will not just be hot commodities. They’ll be business critical.

That’s good news for IR. With customer relationships measured in decades not months, the global software company’s sales engineers and technology architects understand how to build intuitive solutions that monitor and mine the data that matters to their clients and their end customers.

The “Tandem Jims,” Jim Bowers (JB) and Jim Knudsen (JK), have spent their careers supporting NonStop clients, primarily in banking and payments. When they started, ATMs were revolutionary, never mind digital banking. Fast forward to today, and ISO 20022 standards hold the promise (if not the probability) of global interoperability while real-time payments are finally gaining a foothold in nearly every market, including the U.S.

Despite their similar backgrounds and career paths, the Nebraska natives and current Omaha residents didn’t actually meet until they were both expats in Singapore working for ACI. For the last 5 and 9 years, respectively, they’ve been helping IR clients monitor and maintain the health of their mission-critical systems (such as NonStop) and use their data to make better strategy, operations, technology and customer support decisions.

The sales engineers sat down to discuss the evolution of NonStop and where the industry—and those like IR who support it—are headed.

Data: The Problem and Solution

“Our customers have so much data, and they know it’s important,” says JB. “But it can also be overwhelming.”

“It’s not just understanding what’s happening or what has happened,” JK explains. “Replay is one of our most popular features to help clients understand activity before and immediately after any system issues, but the focus is increasingly turning toward predictive applications. What will my systems and my business do in the future? How do we best position ourselves for success from an operational, headcount and technology perspective?”

Initially, system monitoring was more about performance and technical issues—throughput, CPUs and availability. “Those things are still important, but customers are also concerned with gaining a better understanding of profitability,” says JB. “Our product has evolved to meet those demands, too.”

In 2023, IR launched Business Insight as a complement to its Infrastructure solution. One of the key priorities in that rollout was giving non-technologists within a client’s business greater ecosystem visibility in a digestible format and without heavy lifting from the IT or operations teams. (See sidebar for more details.)

Technology Skills and Knowledge Gap

While most companies are facing skills gaps around emerging technology, the flipside for 50-year-old HPE NonStop technology is that experts in the mission-critical system are nearing or reaching retirement age. For the Tandem Jims, their expertise in NonStop and across a variety of payment platforms means they can provide a level of consultation to clients that’s hard to match. Their careers have taken them around the world to work with banks on everything from technology installs to tech support, giving them a breadth and depth of knowledge their clients value.

“I still remember problems I helped solve 30 years ago,” JK laughs. “I’m pretty sure I could still debug a BASE24 device handler. As I approach the later stages of my career, I’m encouraged by the efforts of many organizations to bring in fresh talent before the existing workforce transitions out. For HPE, the key to ensuring success lies in collaborating closely with customers and software providers to highlight the value of NonStop systems and develop mission-critical applications that effectively address market challenges.”

JB also enjoys the problem-solving aspect of his role. “We’ve seen consumer payments evolve from checks and cards to now include PCs, mobile apps and internet banking. The payment rails of the past don’t meet the demands of today,” he explains. “There’s no denying that real-time payments are here to stay. The multi-day settlement cycle is no longer acceptable, and those that securely move money the fastest will prosper with account depositors. The market has a way of rewarding those who innovate and evolve to improve commerce. It’s a question of how fast the industry is willing to evolve,” JB continues. “Now, the sheer amount of data banks have is a pressing problem. They don’t have the time or the ability to begin to analyze it all. IR Infrastructure solution solves for that.”

The Rise of Real-Time

As digital transactions continue to increase and shift toward real-time payments, which grew 42.2% globally in 2023 (ACI), safeguarding payment system health must remain a top priority for banks. Real-time monitoring of infrastructure (NonStop) as well as transactions will be paramount to customer satisfaction, retention and long-term competitiveness, they contend. After all, “the one who knows where their money is in the shortest amount of time wins,” says JB. That’s true for the banks themselves and for their customers.

In such a fast-moving environment, banks cannot afford to take customer loyalty for granted, he continues. “System uptime is just table stakes. If I have an issue and call the bank, I want an answer now. The bank (and the agent) need access to the right information at the right time to be able to explain what’s happening.

“People like to say that Gen Z has no loyalty, but why should they? This idea that older consumers are more loyal or more patient just isn’t true,” JB says. “Customers of any age want their financial tools to work every time—whether that’s POS payments, mobile apps or account-to-account transactions. Consumers have options, and if the first option doesn’t work, they’ll be frustrated while they move on to their next choice.”

Sidebar: IR Infrastructure: Built to Last and Adapt

In 1998 in an apartment above a chicken shop in Sydney, Australia, IR founder Steve Killelea built the very first version of Prognosis that monitored HP NonStop servers. Now called Infrastructure, Powered by Prognosis, the monitoring software is used by the biggest banks in the world and features:

- Nearly 4,000 out-of-the-box dashboards and reports

- Approximately 17,000 individual data elements that can be used to create customized alerts, dashboards and reports

- Enterprise integration – Integrates key performance and availability data from HPE NonStop systems with enterprise management frameworks, such as IBM Tivoli/Netcool, ServiceNow, and any SNMP trap-compatible system

- Automated analyst, which automates multistep and interpretive problem solving using customized or pre-configured rules that analyze and initiate appropriate actions to resolve problems.

- Enterprise summaries of all servers across all clouds and data centers with drill-down precision to identify the most discrete processing elements

In addition to NonStop servers, IR also offers IR Transact which monitors and provides insights into real-time, high value, and card transactions, notes JK. “By monitoring a customer’s entire environment—as well as the communications and interactions between applications, middleware, databases and the outside world—we can provide unmatched visibility to our customers,” he says.

Decades of experience in financial services technology have informed the company’s solutions to speed time to value for new customers. With a clear view of their capacity, system performance and liquidity management forecasts all in one place, banks and processors can better plan for the future. In fact, IR customers say they are more proactive than reactive after using IR solutions, citing a 40% increase in their I&O maturity scale.

![jk2[67]](https://b3575302.smushcdn.com/3575302/wp-content/uploads/sites/8/2024/10/jk267.jpg?lossy=2&strip=1&webp=1)

Be the first to comment