Major U.K. Bank

With about 20 million customers, the bank comprises retail banking operations (including ATM and POS), consumer credit card business, wealth management business, and corporate banking for small, medium, and large-sized businesses in the U.K.

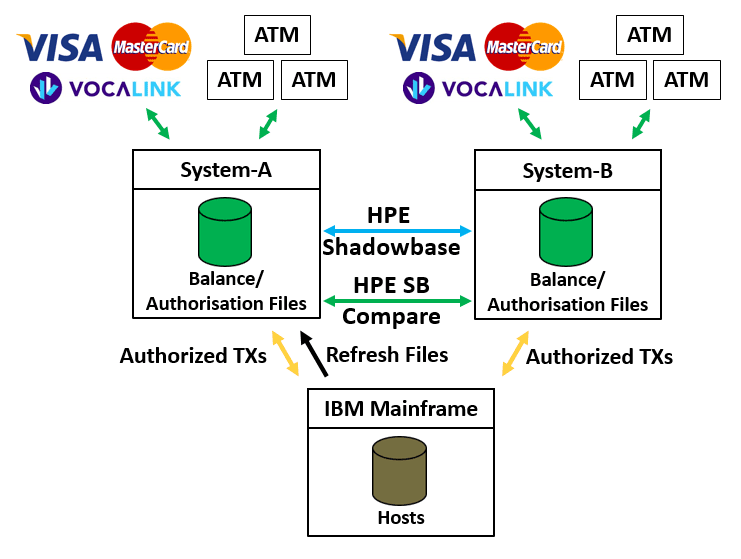

Old Architecture and the Need for Action

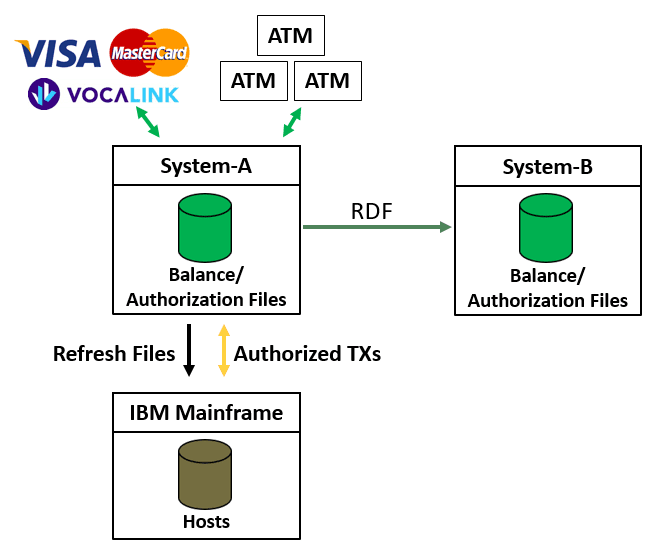

As shown in Figure 1, the old BASE24 environment supported ATM and POS transactions in an Active/Passive architecture. Regular disaster recovery exercises were conducted to build confidence, which increased system downtime. The Active/Passive architecture used RDF and did not provide the desired level of availability.

RDF also had several limitations; it only worked in a uni-directional, Active/Passive mode and was configured for volume/sub-volume-based replication. Also, since 2018, RDF is in “mature” status and will not be enhanced to meet future requirements.

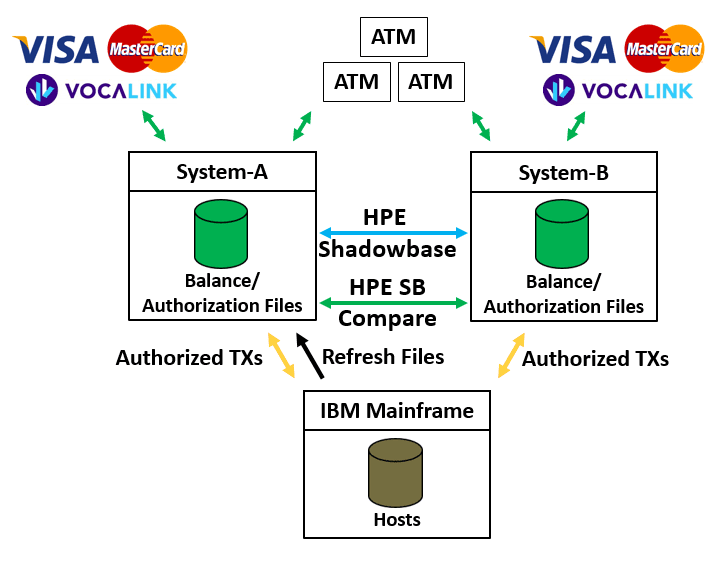

New Architecture

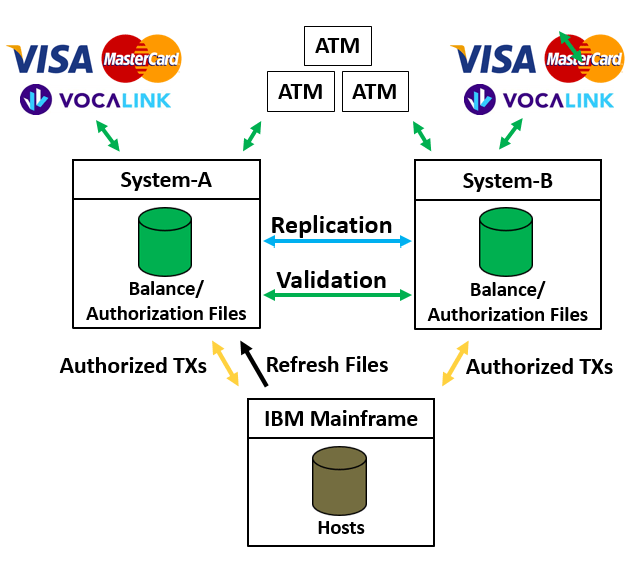

The bank required an Active/Active datacenter (Figure 2), with both sites fully active but tightly coupled with both systems processing ATM/POS transactions. The databases need to be actively accessed with the full utilization of data assets. Data collisions could occur but would be automatically resolved. The bank also wanted a faster RTO (Recovery Time Objective) using bi-directional replication to eliminate the need for planned downtime.

Proof of Concepts

Several POCs were undertaken at various times:

- 2018 – Compare several replication products available in the market

- 2020 – Evaluate and performance test identified replication products

- 2021-22 – Confirm the chosen product meets the requirements

- 2022-23 – Design, test, train, and implement

Additional steps were included to upgrade the HPE NonStop systems via a platform refresh, to work with schemes to become fully Active/Active, and to deal with COVID pandemic delays.

Technical Evaluation

The team held very high standards, performed thorough testing, and underwent a lengthy evaluation. The bank needed the best possible solution to provide mission-critical financial services for its customers.

Several major considerations were reviewed, including:

- replication speed and reliability;

- database creation from existing PROD/DR systems;

- the ability to identify the types of updates and collision management;

- the relative ease at failing over and back for DR testing purposes,

- and the ability to resynchronize following a system failure.

Why HPE Shadowbase was Selected

Gravic and HPE Shadowbase software offered a strong technical evaluation and POC results, coupled with providing very good additional support and professional services.

HPE Shadowbase solutions have a focus on HPE NonStop systems and an excellent long-term relationship with HPE (HPE globally markets, sells, and supports Shadowbase products). Since HPE is a known enterprise and an approved vendor, procurement time was reduced. There was no need for a new procurement procedure, which would have impacted the project timeline.

The bank also reviewed implementation considerations in terms of ACI BASE24 and BASE24 dual-site functionality and utilizing standard POS transaction log files [(P)TLFs]. HPE Shadowbase software supported key aspects of BASE24 functionality and was enhanced to enable the dual-site functionality.

The software worked in both uni-directional and bi-directional mode with file-level replication, which allowed full control of the files that needed to be replicated. The new solution has a more complex configuration but with better management. The design was innovative and was able to create copies of merged (P)TLFs.

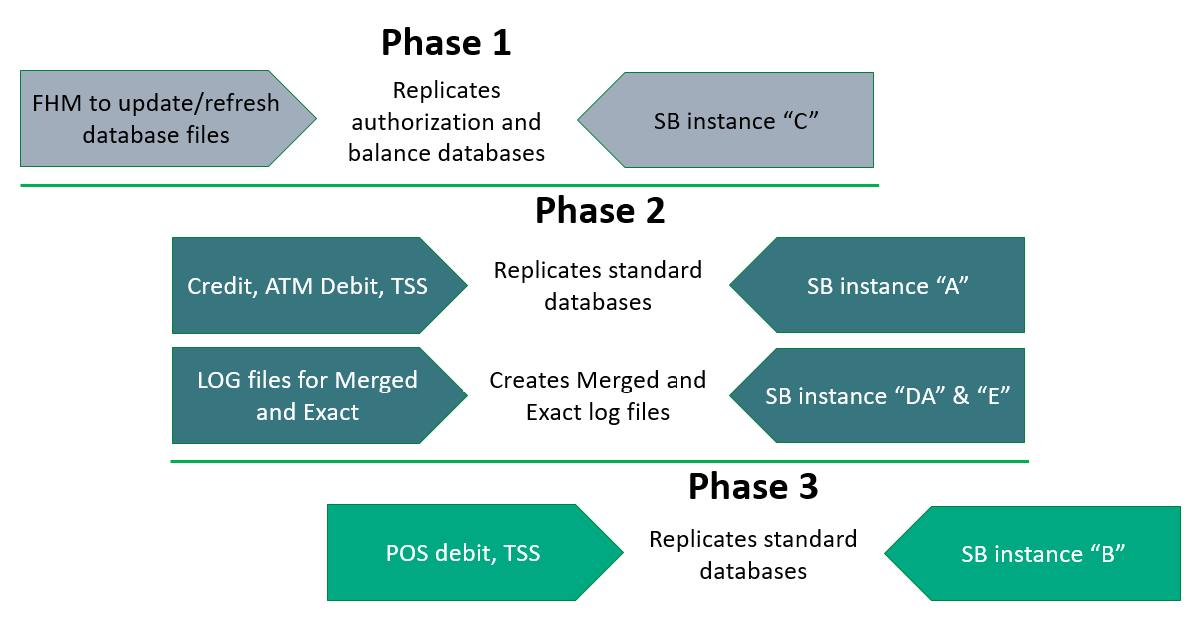

Implementation Approach Summary – Testing and Timing

As shown in Figure 3, a three-phased approach took place based on the number of BASE24 environments versus Shadowbase instances. The migration and testing took about 12 months elapsed time (full-time effort per person), while the implementation took about four months elapsed time (full-time effort per person).

The three-phased approach consisted of:

- Phase 1 – Prepare existing RDF environment

- Phase 2 – Implement Active/Active architecture with Shadowbase software

- Phase 3 – Implement BASE24 dual-site functionality

Migration Phase 1

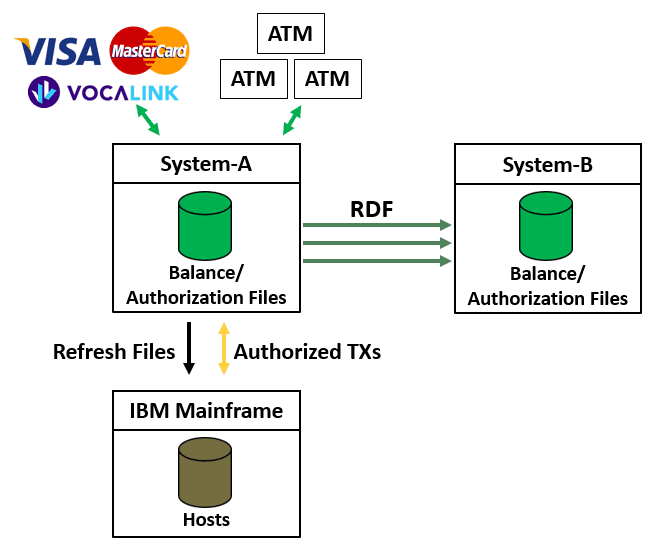

As shown in Figure 4, after the bank completed Shadowbase training, RDF was modified to allow for a three-phased Shadowbase replacement. Then, Shadowbase BASE24 environments were created, and RDF and Shadowbase were uni-directionally run side-by-side to prove that each phase worked. Each RDF phase was then uni-directionally replaced with Shadowbase software.

Migration Phase 2

The bank then implemented HPE Shadowbase Active/Active partitioned architecture and the merged and exact TLF processes (Figure 5):

- Three Shadowbase instances per system were created, and six BASE24 environments were utilized per system.

- Work was done on all interchanges to ensure that each supported the Active/Active architecture.

- Device connectivity and IBM mainframe connectivity were also both reconfigured.

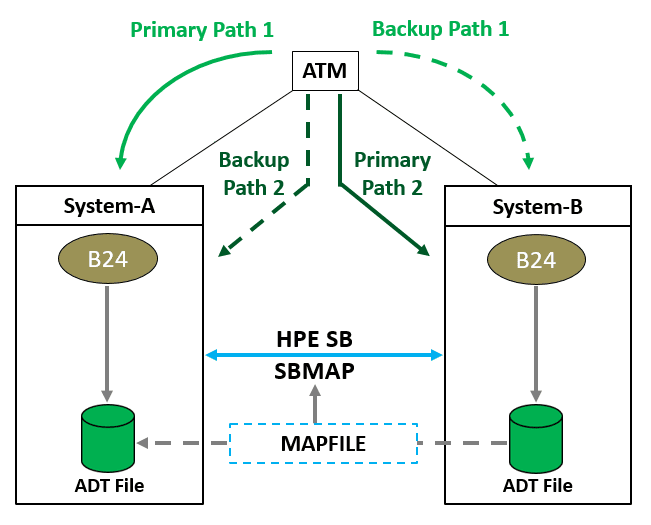

As shown in Figure 6, the Phase 2 state utilized BASE24 dual-site functionality by implementing Shadowbase dual-site functionality and reconfiguring device connectivity.

The HPE Shadowbase Data Mapping Facility (SBMAP) solution was utilized for scripting instead of writing user exits, which saved time, reduced costs, and created a platform for simplifying future enhancements and testing time.

Migration Phase 3

The utilization of BASE24 and implementation of Shadowbase software is now completed in the bank’s final state of dual-site functionality as shown in Figure 7. Shadowbase data collision resolution logic and device connectivity have also both been reconfigured.

Implementation Summary

At the end of the HPE Shadowbase implementation, many technical objectives were met:

- The bank achieved its Active/Active datacenter, with both sites fully active and processing transactions while being tightly coupled.

- The databases are actively accessed with full utilization of data assets.

- Data collisions may occur but will be automatically resolved.

- Faster RTO was achieved by using bi-directional replication.

- The need for planned downtime was eliminated.

Several business outcomes were also met:

- The bank now has continuous availability with its Active/Active payments engine utilizing its full infrastructure with increased capability.

- Today, the bank is more secure with its better data resiliency, improved recovery service, and superior technical solutions.

Keys to Success

Some of the keys to this successful project included close collaboration across multiple teams at the bank, HPE, and Gravic. From the start, there was an open exchange of ideas and approaches, thorough and independent testing was performed, and open discussions were held of any uncovered issues and proposed solutions during the testing process.

HPE Shadowbase software is HPE’s strategic go-forward data replication and streaming solution, globally sold and supported by HPE (or HPE’s regional reseller). Contact your HPE Sales Representative or the authors at Gravic at ShadowbaseSoftware.com for more information.

Be the first to comment